Jewelry sales liberalized for sole proprietors; VAT refunds extended through 2028

Starting from September 1, 2025, sole proprietors in Uzbekistan will be allowed to engage in the sale of jewelry without needing to establish a legal entity. Additionally, individuals who report violations related to precious metals will be eligible for financial rewards.

This change follows the adoption of a presidential decree titled “On Additional Measures to Support the Jewelry Manufacturing Sector.”

According to the decree, effective January 1, 2026, the following benefits will be abolished:

- The VAT exemption for the sale of jewelry and semi-finished products made from precious metals and stones;

- The retail sales fee on gold jewelry.

However, until January 1, 2028, entrepreneurs involved in the production or sale of jewelry will receive automatic VAT refunds – up to 80% – from the republican budget by the 25th of each month.

As of September 1, 2025:

- Sole proprietors will be allowed to legally sell jewelry;

- The State Assay Office will introduce mobile services in Tashkent, Nukus, and regional centers to verify and hallmark the fineness of jewelry items;

- Individuals who report offenses related to precious metals and stones through the “Soliq” mobile app will receive a reward amounting to 50% of the fines collected as a result of their report.

Related News

11:10

Business calls for VAT relief as farming costs rise, but Tax Committee pushes back citing low existing burden

12:12 / 18.07.2025

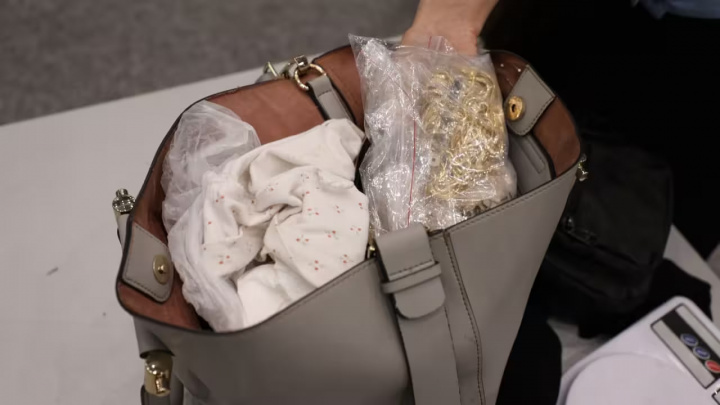

Gold smuggler detained at Fergana border post with UZS 5.2 billion in valuables

19:31 / 11.07.2025

Uzbekistan’s gold giant NMMC doubles revenue in H1 2025, expands mining operations and sustainability efforts

13:04 / 09.07.2025