Uzbekistan’s gold giant NMMC reports 44.6% profit growth in 2024

Navoi Mining and Metallurgical Company (NMMC), the fourth-largest gold producer in the world, increased its gold output by 5.4% in 2024, reaching a record revenue of $7.4 billion. Net profit amounted to $2.1 billion — a 44.6% increase compared to the previous year.

Photo: Sputnik

NMMC, the largest gold mining company in Central Asia and a global top-four gold producer by volume, has published its audited financial results for 2024 in accordance with International Financial Reporting Standards (IFRS).

According to Chairman of the Board and CEO of NMMC, Kuvondik Sanakulov, the company achieved record-high revenue.

“Thanks to the activation of investment projects, over the past eight years, the company has implemented 24 major investment projects worth a total of $3 billion. This allowed us to fulfill the production program originally planned for 2026 already in 2024 — two years ahead of schedule. At the same time, NMMC continues to invest in long-term sustainable growth and maintain its position as one of the lowest-cost gold producers in the industry,” he said.

By the end of 2024, the company produced 3.10 million ounces (96.6 tons) of gold — up 5.4% from 2.94 million ounces (91.4 tons) in 2023. This growth was supported by the launch of new mining and processing facilities.

Revenue rose by 29.5%, reaching $7.4 billion (compared to $5.7 billion in 2023), setting a new record for the company.

Adjusted EBITDA totaled $4.6 billion — an increase of 39.4% — with an EBITDA margin of 62% (compared to 58% the previous year).

Net profit grew by 44.6%, from $1.48 billion to $2.14 billion. This growth is linked to the nearly 23% increase in the average global gold price, which reached $2,389 per troy ounce in 2024 (up from $1,943 in 2023), according to the London Bullion Market Association (LBMA).

Total all-in sustaining costs (AISC) rose to $979 per ounce, compared to $866 the previous year. The increase was mainly driven by higher royalty payments due to strong gold sales, increased fuel costs from expanded mining volumes, and rising labor expenses.

Development-focused investments reached $914 million, marking a 34.6% increase from 2023.

The company’s leverage ratio (net debt to adjusted EBITDA) improved from 0.7x to 0.5x, indicating “a high level of financial stability,” the report said.

In 2024, NMMC successfully placed its first $1 billion Eurobond issuance, split into two tranches of $500 million each, with maturities of 4 and 7 years.

Over the past eight years, NMMC has implemented 24 large-scale investment projects worth $3 billion, solidifying its status as a key global player in the gold market.

Related News

20:54 / 28.07.2025

Navoiyuran and NMMC employees convicted for attempting to illegally sell uranium

12:12 / 18.07.2025

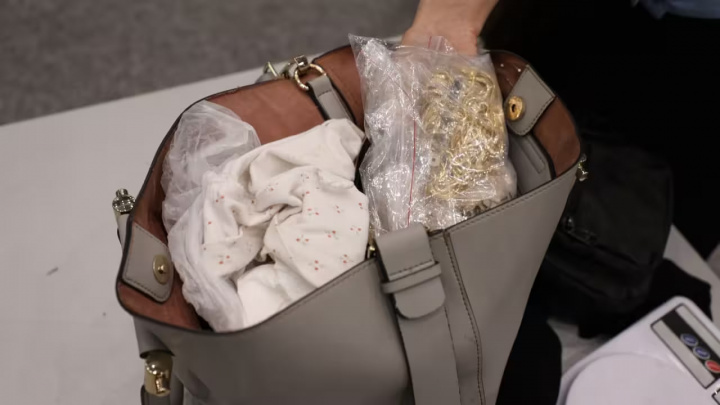

Gold smuggler detained at Fergana border post with UZS 5.2 billion in valuables

19:31 / 11.07.2025

Uzbekistan’s gold giant NMMC doubles revenue in H1 2025, expands mining operations and sustainability efforts

13:04 / 09.07.2025